Pet Insurance Sub-Limits Lessen Your Cover

Shopping Around?

Check for sub-limits.

- Sub-limits are a way some insurers limit what you can actually claim vs your annual max advertised.

- Although often hidden this will be the most critical factor affecting how much pet insurance cover you actually have.

- Do not only focus on your monthly premium or annual max.

What Are Sub-Limits?

Sub-Limit:

A sub-limit is a mini-cap placed on line-items on your invoice for treatments in hospital.

The How:

Sub-Limit Example:

R60 000 Annual Max

The Ruff Reality:

On a bill of R40 000 you could only be refunded R10 000!

I Choose MediPet

Did You Know?

You could be left paying 80% or more of your vet bill, with the wrong pet insurance.

As they say, there is no such thing as a” free lunch”. If it looks too good to be true, there’s likely some consequence or cost that you’re not aware of, but that will come home to roost at some unfortunate time.

So, when choosing pet insurance, be mindful of sub-limits. MediPet is proud to not have sub-limits. You can use your full annual maximum on our comprehensive plans towards expensive treatments or surgeries while hospitalised without the shock of huge unexpected out of pocket expenses due to sub-limit caps.

Understanding Sub-Limits

& What To Look For:

- Lower premiums mean less cover.

- No insurer can pay out the same amount in claims while collecting lower premiums & excesses.

- Sub-limits help insurers offer lower premiums & excesses, critically lessening your cover.

Common Areas Where Sub-Limits

Are Often Applied In Pet Insurance

Pet insurance companies often apply sub-limits to specific treatments.

Here are a few common examples:

Diagnostics

These are a wide range of procedures used to identify specific conditions, diseases, or illnesses.

If your insurer caps diagnostic claims with sub-limits, you could face significant out-of-pocket costs.

Costs To Expect:

- X-rays up to R2 500

- Pathology up to R4 000

- Ultrasounds up to R3 000

Common Sub-Limits (Per Claim):

- X-rays R1 000

- Pathology R1 000

- Radiology R500

Check your pet insurance policy!

Some providers won’t even cover diagnostics or treatment without a diagnosis.

Surgeries

Costs To Expect:

- R2 500: Foreign body removal, for example, your dog ate a sock.

- R45 000: Intervertebral Disc Disease (IVDD) surgery for breeds like daxies prone to back issues.

- R25 000 – R35 000: Bloated stomach/(GDV), an emergency surgery for a twisted, gas-filled stomach. More common in large, deep-chested breeds like Great Danes & German Shepherds.

- R18 000 – R37 000: Cruciate Ligament Repair, a common orthopedic surgery to repair a torn knee ligament. Costs vary for this procedure – one of the highest claim costs in the pet insurance industry.

- R9 000 – R25 000: Bladder Stone Removal (Cystotomy), is a surgery to remove stones from the bladder. While stones can form in any breed, some breeds, for example Dalmatians, are genetically predisposed.

Other Limits Insurers May Impose

Hereditary Limits

Certain breeds are prone to specific conditions & some insurers may impose lower sub-limits caps for these type of treatments.

For example, a German Shepherd puppy may require a Triple Pelvic Osteotomy (TPO) to treat hip dysplasia which is common with this breed. The surgery could cost around R40 000. But what happens if you have a hereditary limit of only R5 000 per claim? MediPet does not have hereditary limits.

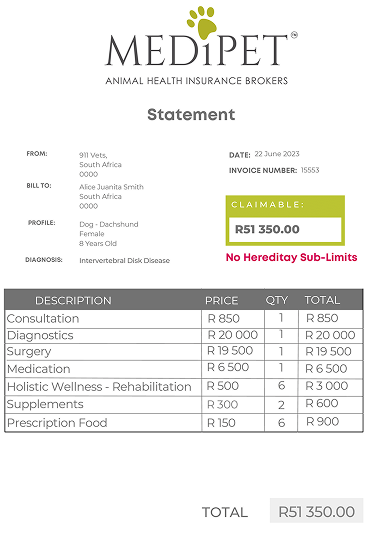

Example Of An Intervertebral Disc Disease (IVDD) Vet Bill,

A Common Hereditary Condition:

Disclaimer: visual references only.

Sub-limits quickly add up, making it impossible to reach your

advertised annual max, as they limit your actual claimable amount.

How Sub-Limits Affect Your Pet Insurance Cover

Sub-limits can significantly impact how much you end up paying out-of-pocket for your pet’s medical care in hospital. Even if your policy seems comprehensive, restrictive sub-limits might leave you with large bills for certain treatments.

MediPet does not have sub-limits. True story! Our premiums may be higher than our competitors’, but that is due to our lack of sub-limits. Members can claim more.

MediPet’s In-House SuperVet Team

Expert MediPet Tips

Choosing Pet Insurance Free Of Unwanted Sub-Limits

When comparing pet insurance policies, ask the following questions to ensure you’re getting the best cover:

Expert MediPet Tips

Choosing Pet Insurance Free Of Unwanted Sub-Limits

Unlike some others, MediPet doesn’t allow sub-limits.

With MediPet, you have peace of mind knowing your pet is fully covered.

Why Is MediPet Different

MediPet Pet Insurance Brokers was founded in 2007 by vet nurse, Louise Griffiths upon her return from working in the UK. At the time South Africa had little pet insurance available. She was deeply moved by the financial struggles pet owners faced when having to make heart breaking decisions regarding their pet’s health.

Louise, as a vet nurse herself, understood the importance of investing in a team of brilliant full-time in-house vets, to assist in designing the cover, & processing all claims – this makes all the difference.

Conclusion:

Know What You’re Getting

Sub-limits are an important factor to consider when choosing pet insurance. They can significantly affect how much cover you have for specific treatments & ignoring them, focusing only on cheaper premiums, will leave you with unexpected, unaffordable out-of-pocket costs.

Since 2007, MediPet have been committed to offering genuine, transparent, comprehensive cover with no sub-limits. We ensure your furry family members get the full care they deserve without unnecessary restrictions. When you choose MediPet, you can rest assured that your pet’s health is our top priority, & there are no hidden limits to their protection!

Always dig deep into the fine print when evaluating pet insurance options, but with MediPet, you know exactly what you’re getting. As always, we love to chat, & transparency is our core value, so reach out anytime with your curious questions, including questions about sub-limits.

For cover you can rely on, choose MediPet today. Join & provide your pet with the protection they truly deserve.